colorado paycheck calculator adp

If your employer offers such benefits think about. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

How to calculate taxes taken out of a paycheck.

. Gross Pay Calculator Important Note on Calculator. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. How do I calculate taxes from paycheck.

Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. It should not be relied upon to calculate exact taxes payroll or other financial data. This colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Colorado Paycheck Calculator Adp. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees w4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or. Colorado hourly paycheck and payroll calculator.

Uncategorized take home pay calculator colorado adp. Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Salary Paycheck Calculator Important Note on Calculator. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

This colorado hourly paycheck calculator is perfect for. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ste 105 Toluca Lake CA 91602.

Overview of colorado taxes colorado is home to rocky mountain national park upscale ski resorts and a flat income tax rate of 45. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. Switch to Colorado hourly calculator. The Premiums Calculator may save you time and hassle and help ensure you pay the correct amount of unemployment insurance premiums.

Change state Check Date General Gross Pay Gross Pay Method. Calculate net salary and tax deductions for all 50 states in the free paycheck calculator payroll calculator is a free quick and easy online paycheck. All Services Backed by Tax Guarantee.

Next divide this number from the annual salary. Hourly Paycheck Calculator Hourly Paycheck Calculator Important Note on Calculator. Colorado Colorado Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

It should not be relied upon to calculate exact taxes payroll or other financial data. The calculator on this page is provided through. Therefore residents are taxed at the same rate of 323 regardless of how much you make or filing status.

Plug in the amount of money youd like to take home each pay period and this. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Based on the information you provide it.

Next divide this number from the. Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. State Date State Colorado.

Determine if you qualify for erc in 2020 and 2021 the sba standard 7a loan. Ad Payroll So Easy You Can Set It Up Run It Yourself. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Colorado tax year starts from july 01 the year before to june 30 the current year.

It should not be relied upon to calculate exact taxes payroll or other financial data. Helpful Paycheck Calculator Info. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

23 Colorado Paycheck Calculator Salary IdeasCalculates federal fica medicare and withholding taxes for all 50 states. Simply enter the calendar year your premium rate for the calendar year found on Your Unemployment Insurance Rate Notice Form UITR-7 and individual employee wage data. Colorado Paycheck Calculator Adp.

So the tax year 2021 will start from july 01 2020 to june 30 2021.

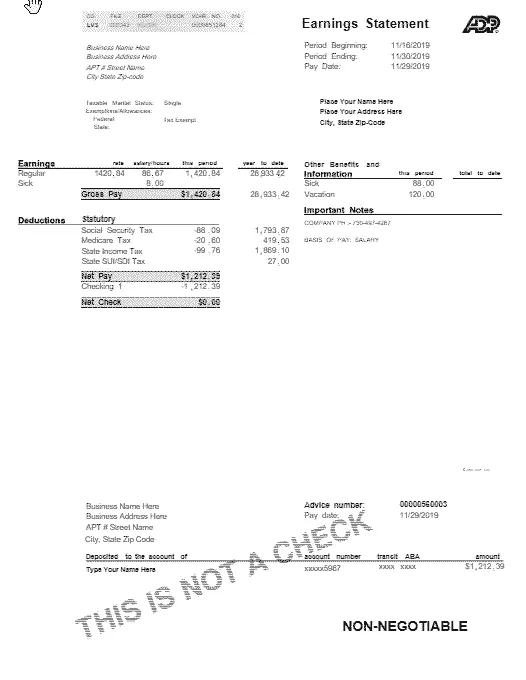

Sample Pay Stub Templates Paycheck Stub Online

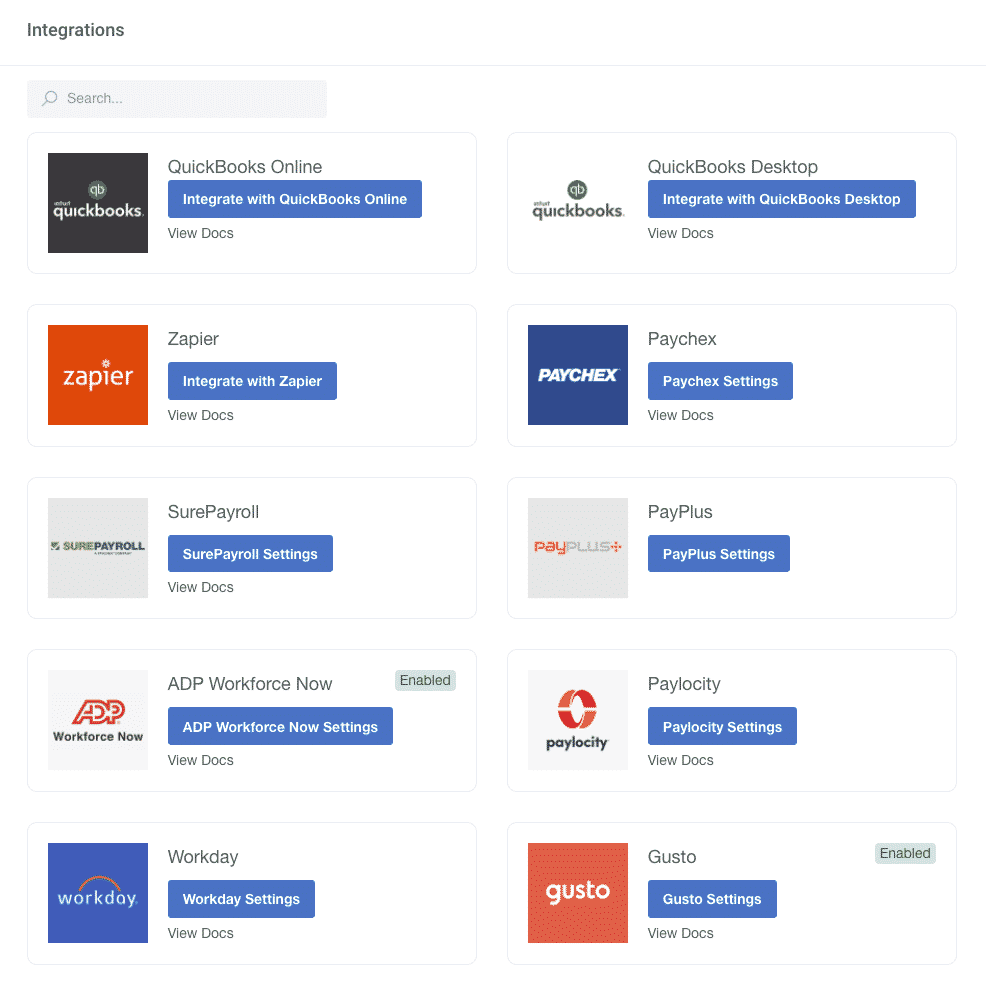

Top 6 Free Payroll Calculators Timecamp

Top 6 Free Payroll Calculators Timecamp

Top 6 Free Payroll Calculators Timecamp

Top 6 Free Payroll Calculators Timecamp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Colorado Paycheck Calculator Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Colorado Paycheck Calculator Adp

Top 6 Free Payroll Calculators Timecamp

Pay Stub Copy Generator Pdfsimpli

Hourly Paycheck Calculator Calculate Hourly Pay Adp

8 Best Employee Time Clocking Apps For Small Businesses In 2022